Target: Manufacturing destinations for investments in India

Integrated solutions to guide your manufacturing strategy from concept to operation

- Aritra Das

- Joshi Seelam

The COVID-19 has exacerbated the uncertainty in the supply chain, prompting manufacturers to reconsider their sourcing strategies. As a result, many companies are expected to eliminate dependence on a single source and establish a flexible and adaptable supply chain. South Asian countries are likely to benefit from this diversification.

Advantage India

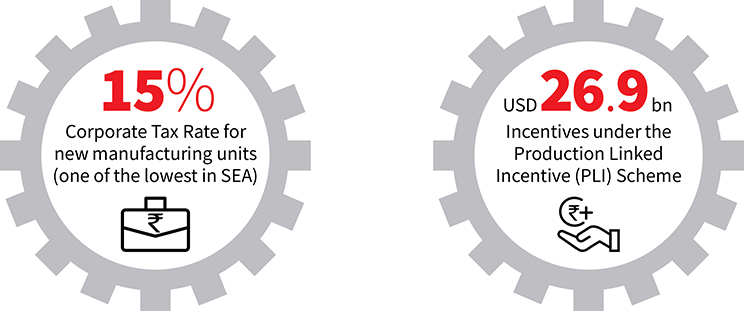

India provides an excellent opportunity for manufacturing units because of its geographic location and domestic market with a large consumption base (18% of global consumers reside in India). The country’s government has taken several measures in the past two years to make India an attractive investment option – improvement in ease of doing business, tax advantage to new manufacturing units, the introduction of production linked incentives, to name a few.

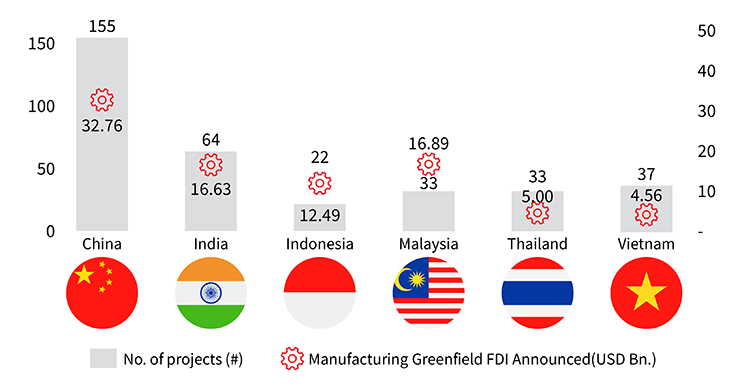

Investments in the past 18 months

The government initiatives and reforms have become fundamental steppingstones to shape India as an efficient, equitable and resilient manufacturing hub. They have resulted in the country witnessing the highest greenfield manufacturing investment intentions among MITI-V countries (Malaysia, Indonesia, Thailand, India & Vietnam), with 64 projects and investments totalling USD 16.63 billion during Jan 2020 – July 2021.

Fig: Greenfield Manufacturing FDI Investment Intentions / MoU (Jan 2020 – Jul 2021)

Source: Moody's Orbis Database

Looking for more insights? Never miss an update.

The latest news, insights and opportunities from global commercial real estate markets straight to your inbox.

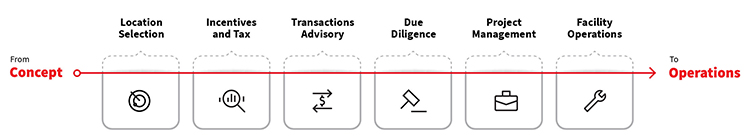

Integrated solutions from concept to operation

Setting up a new manufacturing plant can be a complex and challenging process. We offer a unified solution supporting manufacturers from 'Concept' or location evaluation to the commercial 'Operation' for manufacturing plants in India. It is built and delivered in 6 key stages:

- Target: Identification of the right location in the country

- Analyse: Understanding taxes and incentives applicable

- Transact: Investing in the right site or a suitable building

- Ascertain: Detailed due diligence (legal, technical, environment, health and safety, etc.) of the property

- Develop: Construction of the manufacturing plant

- Manage: Maintenance and operations of the facility

Our solution accommodates the entire range of services an occupier/manufacturer seeks to ground its manufacturing investments in the country and provides a one-stop service that integrates all stakeholders and offers complete visibility of the entire process to the manufacturer.

In the six-part knowledge series, we take you through each milestone of these six stages and the key parameters that can impact the entire process from concept to operation. This is the first blog of the series focusing on the initial stage of the process.

Target

Location Selection: Destinations for investments

Destination selection is the first decision-making step that kick-starts the six-stage process of business entry. India has successfully attracted international and domestic investments across its geography and a vast spectrum of industrial sectors. Here is a snapshot of investment interests in the past 18 months. Investments in India have poured in from around the world with significant interest from China, France, Germany, Japan, Netherlands, South Korea, Taiwan (Chinese Taipei), UK and the US. Most of the manufacturers have plans to Make in India and Go Global from here.

Make in India: International Investment Intentions between Jan 2020 and July 2021

| Company Name | Sector | Country of origin | Million USD at 1USD=INR 74 | State |

|---|---|---|---|---|

| Eickhoff Wind | Other Renewables | Germany | 55 | Tamil Nadu |

| Kia Motors | Auto+EV | South Korea | 54 | Andhra Pradesh |

| Sami-Sabinsa Group | Pharma | USA | 81 | Karnataka |

| Major Oil Co. | Petroleum | USA | 103 | Maharashtra |

| Pegatron | Electronics | Taiwan | 149 | Tamil Nadu |

| Alliance Tire Gr. (ATG) - Yokohama | Auto+EV | Japan | 168 | Andhra Pradesh |

| Defence Manu. Co. | Defence | Russia | 338 | Tamil Nadu |

| Foxconn | Electronics | Taiwan | 541 | Tamil Nadu |

| First Solar | Solar | USA | 566 | Tamil Nadu |

| Samsung | Electronics | South Korea | 652 | Noida, UP |

| IMR Metallurgical Resources-AG | Metal | Switzerland | 1,622 | Andhra Pradesh |

| Wistron | Electronics | Taiwan | 171 | Uttar Pradesh |

| Arcelor Mittal Nippon Steel | Metal | Luxembourg | 6,757 | Gujarat |

| Arcelor Mittal | Solar | Luxembourg | 257 | Rajasthan |

| MG Motor | Auto+EV | China | 203 | Gujarat |

| Wistron | Electronics | Taiwan | 182 | Uttar Pradesh |

| Daicel | Auto+EV | Japan | 31 | Tamil Nadu |

| Transworld Group | Container manufacturing | UAE | 27 | Gujarat |

| Safran SA | Engineering | France | 1,172 | Uttar Pradesh |

| Jabil | Electronics | USA | 405 | Maharashtra |

| TCL Group | Electronics | China | 2,566 | Andhra Pradesh |